Combating GST fraud using Analytics

In 2017, India introduced a comprehensive tax system called the Goods and Services Tax (GST). This new system replaced multiple indirect taxes levied by the federal and state governments, simplifying the tax process for businesses. However, implementing GST has also led to increased fraudulent activities, such as underreporting sales and purchases, claiming input tax credits without supporting paperwork, fabricating invoices, and supplying goods without paying taxes.

Let’s get an idea of what GST fraud is and how Analytics help in combating these frauds-

Let’s say there is a business that sells cell phones. In its GST reports, the company stated that it had a revenue of Rs. 1 crore, of which Rs. 80 lakhs came from the sale of mobile phones and the rest Rs. 20 lakhs came from other sources. The company sold mobile phones worth Rs. 1.2 crore during that time, it was discovered after analysing the sales data. This indicates that the business underreported its revenues by Rs. 40 lakhs, which would have cost the government money.

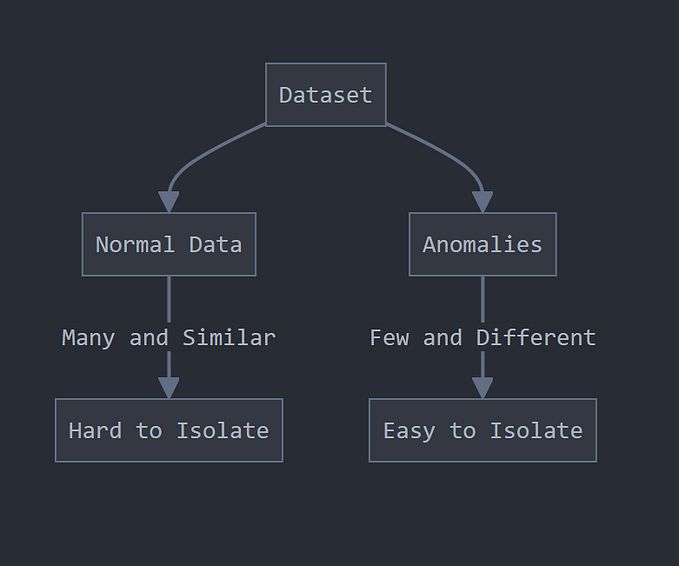

Analytics can be used to examine the company’s sales data to find such underreporting of sales. Analytics can find differences between reported and actual sales by comparing the sales data with the GST returns. Further investigation can be done to ascertain whether these anomalies are a sign of fraud.

Types of GST fraud-

- Circular trading: Also known as round-tripping, it is one of the most common types of fraud in GST. In circular trading, the two companies involved typically exchange goods or services of equivalent value, but each transaction is recorded as a sale or purchase on their respective financial statements. This creates the appearance of legitimate sales and revenue when no actual economic activity has occurred. Circular trading can also involve using false invoices or other documents to support fictitious transactions. For example, three businesses are engaged in a circular trading scheme: A, B, and C. Business A sells goods to Business B, who sells them to Business C. Business C then sells them back to Business A. Each of these businesses claims input tax credit for the purchases, even though there is no actual economic activity or change in ownership of the goods. This allows them to inflate their turnover and claim more input tax credit than they are entitled to.

- Phantom or ghost firms: Analytics tools can detect anomalies in data patterns, such as many transactions with entities with no physical presence or incomplete information. Businesses and authorities can identify and investigate suspicious entities by analysing data from multiple sources, such as tax returns, bank statements, and transaction records.

- Double invoicing: Analytics can help detect patterns of duplicate invoices or transactions involving the same goods or services. Businesses can identify and flag such discrepancies by comparing data across different systems and sources, which can be investigated further.

- Shell companies: Analytics can identify irregularities or discrepancies in the data, such as many transactions with entities with no physical presence or incomplete information. Businesses and authorities can identify shell companies that issue fake invoices and claim input tax credits by analysing transaction patterns.

- Hawala transactions: Analytics can help identify patterns of suspicious financial transactions or movements of funds, such as high-value transfers to unregistered or offshore entities. Businesses and authorities can detect and investigate such transactions by analysing transaction data and financial statements.

- Mismatch in the filing: Analytics can detect discrepancies in GST returns and transaction data, such as differences in transaction values, tax amounts, or dates. Businesses can identify and investigate such discrepancies using data analytics tools and take corrective action.

Here are a few ways analytics can help in solving the fraud:

- Identify suspicious transactions.

- Track the movement of goods and services

- Monitor supplier and customer relationships

- Identify false documents

Recent Frauds in GST

GST evasion of more than ₹1 lakh crore was detected in the last fiscal ended on March 31. The total number of GST evasion cases had increased, with about 14,000 cases detected in 2022–23, up from 12,574 cases in 2021–22 and 12,596 cases in 2020–21.

Measures Taken by Government

The government has also put policies like e-invoicing and e-way bills that aid in detecting fraudulent operations. Additionally, fines and penalties have been enacted for disregarding the GST rules. As a result of these measures, the government has yielded encouraging results in combating GST fraud.

In conclusion, while introducing GST has simplified the business tax process in India, it has also led to increased fraudulent activities. However, analytics and data science tools can help identify and deter these activities. The government has implemented programs to combat GST fraud, including data analytics tools, policies like e-invoicing and e-way bills, and fines and penalties for disregarding GST rules. To maintain the effectiveness of these measures, the government must continue to invest in analytics and data science tools to ensure that GST functions as a transparent and efficient tax system.